part 1:

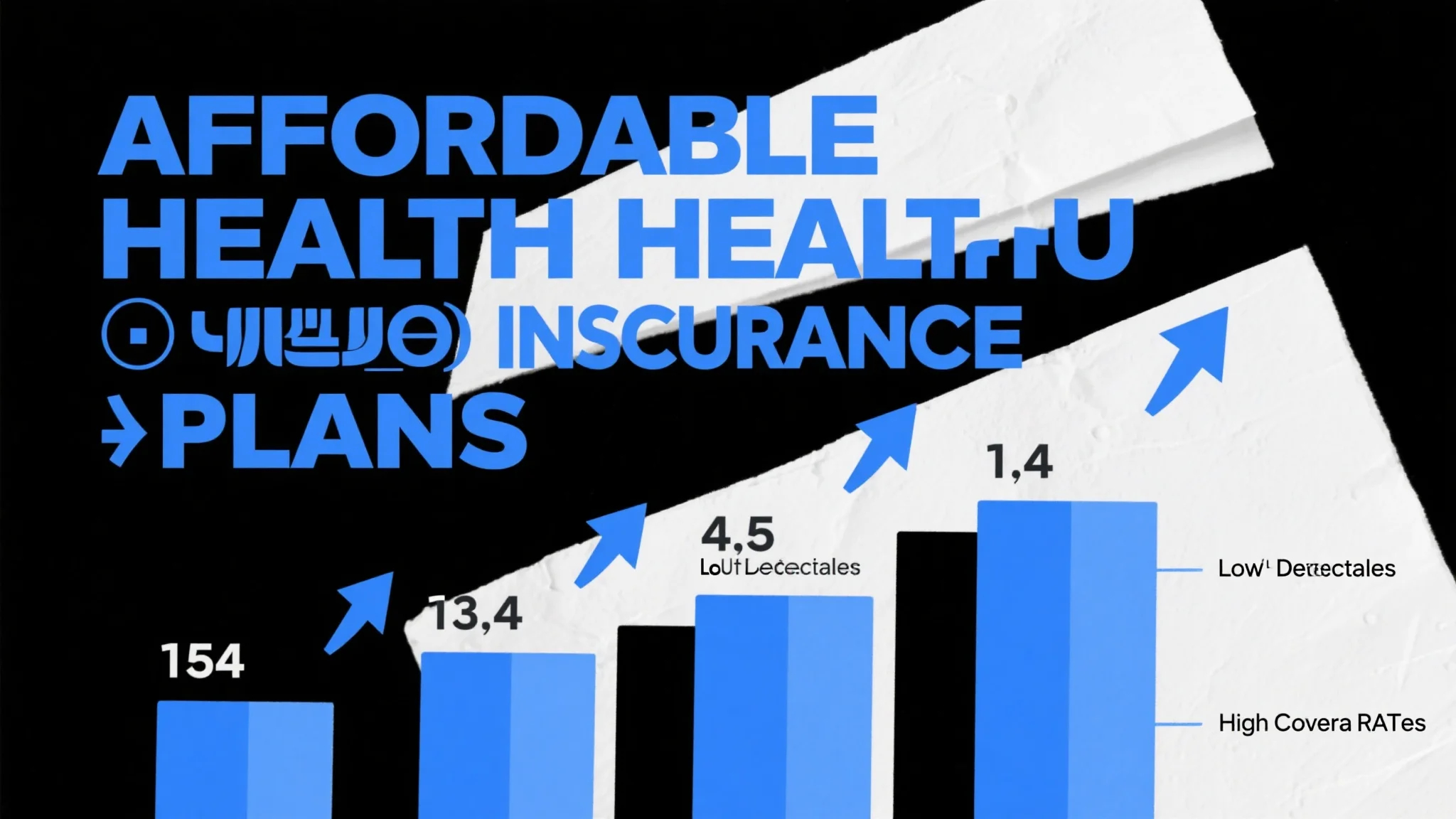

For many families, finding affordable health insurance can feel like an overwhelming challenge. High premiums, deductibles, and copays often make it difficult to balance healthcare needs with financial priorities. However, budget-conscious families don’t have to sacrifice quality care to stay within their means. With careful research and strategic planning, there are numerous low-cost health insurance solutions available that cater to families on a budget.

One of the most effective ways to reduce healthcare costs is by exploring government-sponsored health insurance programs. The Affordable Care Act (ACA), commonly known as Obamacare, offers subsidies to help lower the cost of health insurance for eligible individuals and families. If your household income falls between 100% and 400% of the federal poverty level, you may qualify for premium tax credits, which significantly reduce your monthly premiums. Additionally, the ACA prohibits insurers from denying coverage based on pre-existing conditions, ensuring that even families with health challenges can access affordable plans.

Another option for budget-conscious families is the Medicaid program, which provides free or low-cost health insurance to low-income individuals and families. Eligibility criteria vary by state, but Medicaid often covers essential health benefits, including doctor visits, hospital stays, and prescription drugs. Families with children may also qualify for the Children’s Health Insurance Program (CHIP), which offers low-cost or no-cost coverage to kids who don’t meet Medicaid’s income requirements.

For families who aren’t eligible for government programs, there are still ways to find low-cost health insurance. Many private insurance providers offer plans with lower premiums and higher deductibles, which can be a cost-effective solution for families who rarely visit the doctor. Additionally, some employers offer health insurance plans with employee contribution options, allowing families to choose coverage that fits their budget.

It’s also worth exploring health insurance through professional associations or unions. Some organizations provide discounted rates on health insurance plans, making it easier for families to afford coverage. Furthermore, comparing quotes from multiple providers using online health insurance marketplaces can help you find the best deals and ensure you’re not overpaying for coverage.

Another strategy for reducing healthcare costs is to prioritize preventive care. By staying on top of routine check-ups, vaccinations, and screenings, families can avoid costly medical emergencies down the line. Many health insurance plans cover preventive services at little to no cost, making it a smart way to protect both your health and your wallet.

part 2:

In addition to government programs and private plans, there are alternative options for families looking to reduce their healthcare expenses. One such option is healthcare sharing ministries, which are faith-based organizations that allow members to share healthcare costs. These programs are often more affordable than traditional insurance and may cover a range of medical services, though they typically require members to meet certain eligibility criteria.

Another approach is to consider short-term health insurance if your family has temporary healthcare needs. These plans are designed to provide coverage for a specific period, such as a few months or a year, and can be a cost-effective solution for families waiting for employer-sponsored coverage or those who need coverage during a transition period.

For families with children, it’s essential to explore school-based health insurance programs. Many schools partner with insurance providers to offer low-cost plans to students and their families. These plans often include coverage for routine care, dental services, and mental health support, making them a valuable resource for budget-conscious families.

Long-term care insurance is another consideration for families who want to ensure they’re prepared for future healthcare needs. While these plans can be expensive, they may be more affordable for families who purchase them when the primary breadwinner is younger and healthier. Additionally, some long-term care policies offer discounts for couples or families, making them a more accessible option.

It’s also important for families to regularly review their health insurance plans to ensure they’re paying for the coverage they need. As your family’s healthcare needs evolve, so should your insurance plan. For example, if you have a new child or a family member with chronic health conditions, you may need to upgrade your plan to include additional benefits or lower deductibles.

Finally, don’t overlook the importance of health savings accounts (HSAs). If you’re enrolled in a high-deductible health plan (HDHP), you may be eligible to contribute pre-tax dollars to an HSA. These savings can be used to pay for eligible medical expenses, including copays, prescriptions, and dental care, making it a powerful tool for managing healthcare costs.

In conclusion, budget-conscious families have more options than ever when it comes to finding low-cost health insurance solutions. By leveraging government programs, exploring alternative coverage options, and prioritizing preventive care, families can ensure they have the coverage they need without breaking the bank. Remember, healthcare is an investment in your family’s well-being, and with the right strategies, you can protect both your health and your finances.